Trust Issues: New Alternative Minimum Tax Changes = Maximum Headaches

07/16/2024

With some of the 2024 tax changes from the Federal Budget now in effect, trusts used for income splitting that rely on financing strategies like prescribed rate loans may now face taxes that they weren’t previously subject to.

With some of the 2024 tax changes from the Federal Budget now in effect, trusts used for income splitting that rely on financing strategies like prescribed rate loans may now face taxes that they weren’t previously subject to.

To help understand how these changes may impact you, we've created a short primer on:

- Prescribed rate loan trusts and their purpose

- AMT changes impacting these trusts, with an example

- Key planning steps for trustees to consider

What is a Prescribed Rate Loan Trust?

A prescribed rate loan trust is a tax-saving strategy that allows Canadians to split income with family members, typically those in lower tax brackets, by lending money to a trust at the prescribed interest rate set by the Canada Revenue Agency (CRA).

The trust then invests this borrowed money to generate income. The trust's income (after paying the prescribed interest rate) is then distributed to the trust’s beneficiaries and taxed in their hands—often at a lower tax rate—or not taxed at all, if the beneficiary’s personal tax credits are sufficient.

Why is This Strategy Used?

By paying interest at the prescribed rate, this strategy avoids tax attribution rules that would otherwise attribute the income back to the high-income lender if they gifted or loaned money directly to the trust or a low-income family member for investment. Additionally, by distributing the net income (after interest costs) to beneficiaries, the trust itself doesn’t have taxable income and therefore doesn’t owe tax.

This strategy was particularly appealing during periods of low interest rates, when the prescribed rate charged to the trust was just 1% or 2% and the rate could be “locked in” for the duration of the arrangement. As long as the trust's investment income exceeded the prescribed interest rate, the excess could be shared with family members in lower tax brackets. However, recent interest rate increases have made this strategy less attractive to implement today1.

What is Alternative Minimum Tax?

Alternative Minimum Tax (AMT) is a parallel tax system designed to ensure that individuals and most trusts pay a minimum level of tax, regardless of deductions, exemptions, or credits that might otherwise reduce their tax liability under the regular tax system. The AMT recalculates income tax after adjusting income calculated under the regular tax system.

If the AMT exceeds the regular tax liability, the taxpayer pays the higher amount. But AMT paid is not necessarily lost; it can be credited against regular tax liabilities for the following seven years, if there is sufficient regular tax in those years.

For individuals, there is a basic annual exemption from AMT of $173,205 for 2024 (indexed to inflation), which helps ensure it only applies to individuals with higher incomes. However, this exemption does not apply to trusts.

What AMT Changes Will Affect Prescribed Rate Loan Trusts?

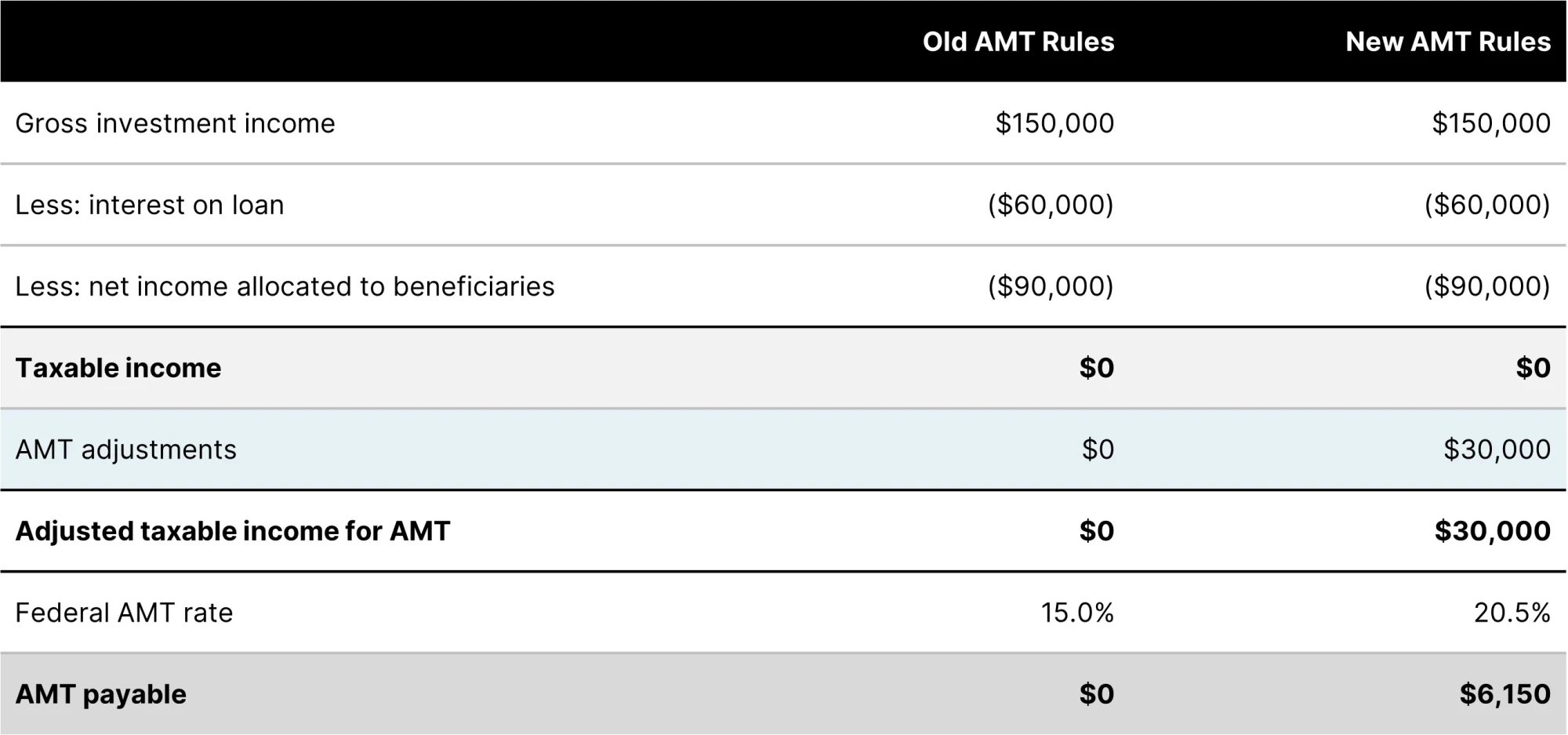

Several changes have been made to AMT (effective January 1, 2024), including increasing the federal AMT rate from 15% to 20.5%. The key change impacting prescribed rate loan trusts is that now only 50% of the interest paid on most investment loans will be deductible (compared to 100% previously) when calculating AMT. This means that even if all trust income is allocated to beneficiaries and the trust has no regular taxable income, it may still be subject to AMT.

Example

An individual lent $3,000,000 to a trust when the prescribed rate was 2%. The trust invested these funds in a portfolio of securities, generating $150,000 in gross investment income annually. The net income is allocated to the individual’s children, who are the beneficiaries of the trust. For simplicity, let’s assume the trust has no other expenses.

In this example, the trust will owe $6,150 in federal AMT, despite previously having no tax liability because all income was allocated to beneficiaries each year.

Additionally, provincial AMT will apply based on the province of residence, generally calculated as a multiple of the federal AMT. For example, in Ontario, provincial AMT is 33.67%2 of the federal AMT (adding $2,070 of provincial AMT liability in this example). In Alberta, provincial AMT is 35%, resulting in an additional $2,153 in AMT liability.

Trusts with prescribed rate loans at higher interest rates will face an even greater AMT burden due to the 50% AMT adjustment applying to larger amounts.

1 The current prescribed interest rate is 4%.2 The October 30, 2024 Ontario Fall Statement proposes to lower this rate to 24.63% beginning in 2024.

What Should These Trusts Do?

Trusts with a prescribed rate loan should prepare for the new potential AMT exposure. Trustees are encouraged to consult their tax and legal advisors to evaluate their options, including:

Planning for tax liability: Anticipate the AMT impact and, if feasible, use trust capital to cover the AMT.

Reassess interest deductions: Forego some or all of the interest deduction when calculating regular taxes payable to ensure the trust generates enough regular income tax to offset the AMT.

Adjust income allocations: Retain more net income within the trust instead of allocating it to the beneficiaries, allowing the trust to generate sufficient regular income tax to offset the AMT.

Evaluate the loan arrangement: Consider whether the prescribed rate loan arrangement remains beneficial. If not, consider unwinding it, but only after a detailed assessment with your tax and legal advisors.

Our Tax and Estate Planning team is here to guide you through these new AMT changes. Contact your Investment Counsellor to explore how we can best support you and your trust’s planning needs.